Running a successful business in Ontario requires careful planning and consideration. One crucial aspect often overlooked is obtaining the right insurance coverage. Unexpected events can strike at any time, potentially causing significant financial hardship. That's why it's essential to obtain comprehensive business insurance to minimize risks and safeguard your valuable assets.

To ensure you have the most appropriate coverage for your particular needs, we encourage you to request quotes from reputable insurance providers in Ontario today.

Comparing quotes from different insurers allows you to evaluate various options, discovering the best value and coverage alignment for your business. Remember, investing in sound insurance is a smart decision that can provide invaluable peace of mind and financial protection.

The City of Oshawa's Top Brokers Now Offer Commercial Insurance Solutions

Exciting news for enterprises in Oshawa! The top real estate brokers in the area are now providing a comprehensive range of commercial insurance Businesses have more options with Roughley Insurance Ontario solutions. This suggests that local businesses can easily access the protection they need to insure their operations, assets, and staff. Including general liability to property coverage and specialized insurance, these brokers are prepared to help businesses mitigate risk and guarantee financial stability.

- Businesses can now reach out to top brokers for a complimentary consultation.

- The brokers are dedicated to meeting the unique insurance needs of Oshawa's businesses.

- Through choosing a trusted broker, businesses can benefit expert advice and comprehensive coverage.

Understanding Commercial Insurance Costs in Ontario

Navigating your commercial insurance landscape within Ontario can be difficult. Numerous variables influence premiums, making it crucial to understand its key drivers. Costs are generally determined by some mixture of factors such as sector, sales, site, security needs, and incidents history. Companies carefully evaluate these elements to establish the suitable premium for their business.

To guarantee you receive favorable costs, it is suggested to:

* Carry out thorough research and analyze estimates from multiple providers.

* Keep a clean losses history by implementing strong risk management practices.

* Speak with an specialist who can advise you on the optimal coverage options for your specific needs and budget.

Understanding these factors and taking these steps can help you secure cost-effective commercial insurance coverage for your Ontario company.

Find Business Insurance Premium Quotes Online, Ontario

Finding the right business insurance policy can be a daunting task. With so many different insurers available in Ontario, it can be difficult to know where to start. Fortunately, there are now numerous online platforms that allow you to swiftly compare business insurance premium quotes from various different providers side by side.

This can save you a lot time and effort, and help you find the most affordable option for your needs. When comparing quotes online, be sure to look at all of the essential coverage options that your business needs.

Don't just focus on the lowest premium; make sure you are also getting the suitable level of coverage to protect your business from potential risks.

Ontario: Navigating Your Commercial Insurance Options

Operating a business in Ontario presents unique opportunities and challenges. To safeguard your investment and protect your operations from unforeseen events, acquiring the right commercial insurance coverage is paramount. Ontario's marketplace offers a diverse range of insurance providers, each with their own policy offerings. Determining the optimal policy for your specific needs can seem daunting.

- Start by evaluating your business's unique risks. Consider factors such as your industry, size, employee count, and assets value.

- Compare various insurance providers in Ontario to gain insight into their protection. Don't hesitate to seek quotes from multiple companies to contrast pricing and policy terms.

- Seek guidance from an experienced insurance specialist who can suggest tailored solutions that align your business's requirements. Their expertise can be invaluable in interpreting the complexities of commercial insurance.

By taking a proactive approach and conducting thorough research, you can obtain the right commercial insurance coverage to minimize risks and provide your Ontario-based business with the protection it needs to thrive.

Securing Your Business: Essential Commercial Insurance in Ontario

Every successful business in Ontario understands the importance of robust risk management. Commercial insurance provides a vital shield against unforeseen events that could hinder your operations and success. From property damages to lawsuits, commercial insurance protects you from a wide range of potential challenges.

- Standard coverage types include:

- Professional liability

- Business property coverage

- Cybersecurity

Meeting an knowledgeable agent is essential to assess the specific coverage your business demands. They can help you develop a customized program that satisfies your unique needs. Don't underestimate the importance of commercial insurance in Ontario. It's an essential tool for protecting your business's future.

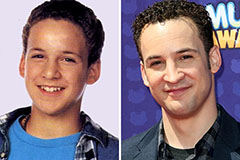

Ben Savage Then & Now!

Ben Savage Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Michael C. Maronna Then & Now!

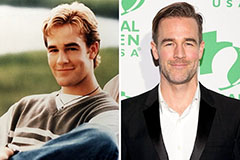

Michael C. Maronna Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!